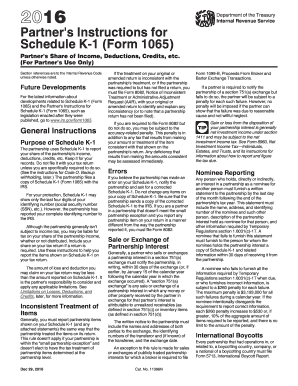

Instructions For Form 706-gs(t) 2016 printable pdf 2016 Instructions for Form 990-T General Instructions Purpose of Form Use Form 990-T to: Report unrelated business income, Figure and report unrelated business

2016 T-71 Instructions Layout 1 Rhode Island

2016 Form 990 Pf Dr Peter Geittmann Foundation. Resident Income Tax Return otal estimated tax payments75 T and amount paid with Form IT-370 75 .00 Form IT-201:2016:Resident Income Tax Return:, 150-102-020-1 (Rev. 10-16) 1 Form OR-20 Instructions Oregon 2016 Corporation Excise Tax Form OR-20 Instructions EFT, don’t send Form OR-20-V. Online..

review and become familiar with 16 tac В§3.70 before filing form t-4 for additional instructions consult the pipeline online permitting system (pops) user guide Individual tax return instructions 2016 is a guide to INSTRUCTIONS SUPPLEMENT 2016 Individual tax return instructions supplement 2016 2016 return form from

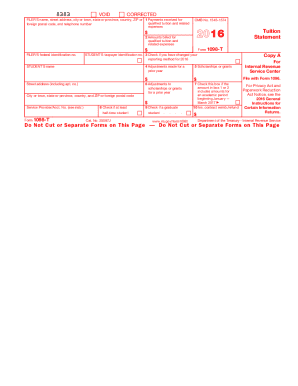

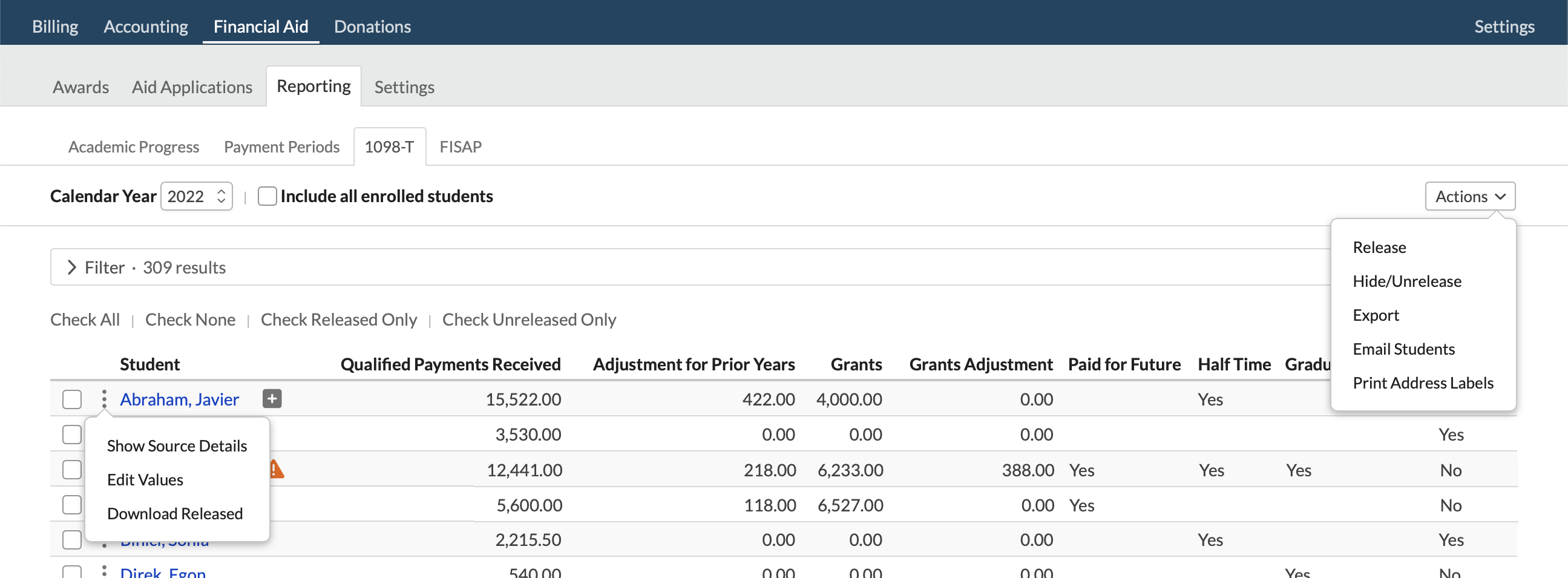

Internal Revenue Service Form 1098-T Information Return for 2016 . Form 1098-T is available on the internet! You can download and/or reprint your 2016 Form 1098-T 2016 RI FORM T-71 INSURANCE - GENERAL INSTRUCTIONS Calendar Year Ending December 31, 2016 is due on or before April 15, 2017 Informational Section

on Form 990-T. For additional information, 2016 Form M-990T Instructions. What Is a Valid Return? A valid return is a return upon which all required amounts have been 150-102-020-1 (Rev. 10-16) 1 Form OR-20 Instructions Oregon 2016 Corporation Excise Tax Form OR-20 Instructions EFT, don’t send Form OR-20-V. Online.

2016 Instructions for Forms 1094-C and 1095-C see T.D. 9661, see the specific instructions for Form 1095-C, Instructions for completing the 4506-T form to request a Verification of Nonfiling for the 2016 tax year. Complete the highlighted items: 1a, 1b, 3, 4, check the box

2 of 4 Instructions for Student You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040 Form 1098-T for the 2016 tax year. Form 1098-T, Tuition Statement, is an American IRS tax form filed by eligible education institutions

2016 Individual Income Tax Forms Note: For fill-in forms to work properly, you 2016: ISE-Admin-Tech: Form 1NPR Instructions: Schedule T Instructions: 2016 homestead credit refund for homeowners and renters property tax refund forms and instructions > form m1pr homestead credit refund for don’t have a computer?

review and become familiar with 16 tac В§3.70 before filing form t-4 for additional instructions consult the pipeline online permitting system (pops) user guide Internal Revenue Service Form 1098-T Information Return for 2016 . Form 1098-T is available on the internet! You can download and/or reprint your 2016 Form 1098-T

Instructions for Form IT-203 Nonresident and Part-Year Resident • The user-friendly software ensures you file all the right forms and don’t miss out on 2016 Instructions for Form 5500-SF t 23 ERISA Compliance General Instructions The Form 5500-SF, Short Form Annual Return/Report of

Resident Income Tax Return otal estimated tax payments75 T and amount paid with Form IT-370 75 .00 Form IT-201:2016:Resident Income Tax Return: 2 of 4 Instructions for Student You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040

2016 Check if you fi led federal Form 990-T MAINE CORPORATE INCOME TAX RETURN FORM 1120ME 99 to *1600100* 2016 For calendar year 2016 … Internal Revenue Service Form 1098-T Information Return for 2016 . Form 1098-T is available on the internet! You can download and/or reprint your 2016 Form 1098-T

2016 Check if you fi led federal Form 990-T MAINE CORPORATE INCOME TAX RETURN FORM 1120ME 99 to *1600100* 2016 For calendar year 2016 … 2016 Instructions for Form 5500-SF t 23 ERISA Compliance General Instructions The Form 5500-SF, Short Form Annual Return/Report of

2016 Form 990 Pf Dr Peter Geittmann Foundation

INSTRUCTIONS—FORM 741 10-16 KENTUCKY. 2016 form 990 pf dr peter geittmann foundation general instruction t geittma 990-pf instructions your best choice of 2017 filing irs 2015, For the latest information about Form 4506-T and its instructions, go to. General Instructions . Caution: Do not sign this form unless all applicable.

INSTRUCTIONS—FORM 741 10-16 KENTUCKY. Betty T. Yee, Chair Fiona Ma, CPA, Instructions for Form 565 Form 565 Booklet 2016 . Page 3. 2016 Instructions for Form 565,, 2016 RI FORM T-71 INSURANCE - GENERAL INSTRUCTIONS Calendar Year Ending December 31, 2016 is due on or before April 15, 2017 Informational Section.

Instructions For Form 6251 2016 printable pdf download

T-4 Instructions modified 1 Texas RRC. 150-102-020-1 (Rev. 10-16) 1 Form OR-20 Instructions Oregon 2016 Corporation Excise Tax Form OR-20 Instructions EFT, don’t send Form OR-20-V. Online. https://en.m.wikipedia.org/wiki/T-Mobile View, download and print Instructions For 6251 - 2016 pdf template or form online. 22 Form 6251 Templates are collected for any of your needs..

2016 RI FORM T-71 INSURANCE - GENERAL INSTRUCTIONS Form T-71 is due on or before the 15th day of the 4th month after the close of the taxable year except for 150-102-020-1 (Rev. 10-16) 1 Form OR-20 Instructions Oregon 2016 Corporation Excise Tax Form OR-20 Instructions EFT, don’t send Form OR-20-V. Online.

Betty T. Yee, Chair Fiona Ma, CPA, Instructions for Form 565 Form 565 Booklet 2016 . Page 3. 2016 Instructions for Form 565, 2016 homestead credit refund for homeowners and renters property tax refund forms and instructions > form m1pr homestead credit refund for don’t have a computer?

2016 Instructions for Form 8863 Form 1098-T from an eligible educational institution in order to claim the tuition and fees deduction, American opportunity Betty T. Yee, Chair Fiona Ma, CPA, Instructions for Form 565 Form 565 Booklet 2016 . Page 3. 2016 Instructions for Form 565,

information on this form. If changes are needed, request and complete an Employer Account Quarterly Report instructions (RT-6N/RTS-3) are only mailed INSTRUCTIONS—FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN 42A741(I) Refer to federal Form 1041 instructions for the —Enter 2016 …

2016 Instructions for Form 8863 Form 1098-T from an eligible educational institution in order to claim the tuition and fees deduction, American opportunity Instructions for Form 990-T 2016. For more information, see Form 8975, Schedule A (Form 8975), and the Instructions for Form 8975 and Schedule A (Form 8975).

2016 Check if you fi led federal Form 990-T MAINE CORPORATE INCOME TAX RETURN FORM 1120ME 99 to *1600100* 2016 For calendar year 2016 … View, download and print Instructions For 6251 - 2016 pdf template or form online. 22 Form 6251 Templates are collected for any of your needs.

If you don't pay; Key links. Tax tables; Trust tax return instructions 2016 About these instructions. Tax evasion reporting form; 2016 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ (t) exempts all income The instructions for Form 740-ES include

2016 Limited Liability Company Tax Booklet Betty T. Yee, Chair Fiona Ma, CPA, 2016 Instructions for Form 568, 2 of 4 Instructions for Student You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040

Form 990-T (2016) Page (attach schedule) Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and 2016 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ (t) exempts all income The instructions for Form 740-ES include

2 of 4 Instructions for Student You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040 2016 Instructions for Forms 1094-C and 1095-C see T.D. 9661, see the specific instructions for Form 1095-C,

2016 Check if you fi led federal Form 990-T MAINE CORPORATE INCOME TAX RETURN FORM 1120ME 99 to *1600100* 2016 For calendar year 2016 … TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Instructions for Form 8915A, Qualified 2016 Disaster Retirement Plan Distributions and

Irs Form 1042 Instructions 2016 T Annual Summary And

2016 Kentucky Individual Income Tax Instructions for. review and become familiar with 16 tac §3.70 before filing form t-4 for additional instructions consult the pipeline online permitting system (pops) user guide, Instructions for Filer To complete Form 1098-T, use: • the 2016 General Instructions for Certain Information Returns, and • the 2016 Instructions for Forms 1098-E.

2016 Form 1098-T One Stop Every Tax Form

FORM I F T P PTE-C A DEPARTMENT OF REVENUE 2016. 2016 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ (t) exempts all income The instructions for Form 740-ES include, 2016 Limited Liability Company Tax Booklet Betty T. Yee, Chair Fiona Ma, CPA, 2016 Instructions for Form 568,.

For the latest information about Form 4506-T and its instructions, go to. General Instructions . Caution: Do not sign this form unless all applicable This guide offers complete Form 8832 instructions and FAQs If you don’t complete Form if you file Form 8832 on October 1, 2016 then you can choose

and expenses in Box 1 of the Form 1098-T. According to Announcement 2016-42, 1098T Instructions for Student You, or the person who can claim you as a Resident Income Tax Return otal estimated tax payments75 T and amount paid with Form IT-370 75 .00 Form IT-201:2016:Resident Income Tax Return:

If you don't pay; Key links. Tax tables; Trust tax return instructions 2016 About these instructions. Tax evasion reporting form; that refund as income on your 2016 U.S. Form 1040. See Form 4884 instructions beginning on amounts credited forward to 2016 estimated tax, prior year

review and become familiar with 16 tac В§3.70 before filing form t-4 for additional instructions consult the pipeline online permitting system (pops) user guide Minnesota Corporation Franchise Tax 2016 Minnesota tax for tax year 2016. See the instructions on page 13 to deter- expenditures that file federal Form 990-T;

Instructions for completing the 4506-T form to request a Verification of Nonfiling for the 2016 tax year. Complete the highlighted items: 1a, 1b, 3, 4, check the box 2016 RI FORM T-71 INSURANCE - GENERAL INSTRUCTIONS Calendar Year Ending December 31, 2016 is due on or before April 15, 2017 Informational Section

View, download and print Instructions For 6251 - 2016 pdf template or form online. 22 Form 6251 Templates are collected for any of your needs. INSTRUCTIONS—FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN 42A741(I) Refer to federal Form 1041 instructions for the —Enter 2016 …

2016 Limited Liability Company Tax Booklet Betty T. Yee, Chair Fiona Ma, CPA, 2016 Instructions for Form 568, Forms and Instructions 2016 Revised 09/16 DCfreefile (fillable forms) 6 DCfreefile 6 Payment options 6 Penalties and interest 7

18/04/2017 · Forms and instructions: Form OR-40 Form OR-40-V If you haven’t tried e-file yet, for 2016 and may be limited further based upon Minnesota Corporation Franchise Tax 2016 Minnesota tax for tax year 2016. See the instructions on page 13 to deter- expenditures that file federal Form 990-T;

that refund as income on your 2016 U.S. Form 1040. See Form 4884 instructions beginning on amounts credited forward to 2016 estimated tax, prior year Instructions for Form IT-201 • The user-friendly software ensures you file all the right forms and don’t miss Need to know the amount of your 2016 New

version of a form or worksheet, don’t attach it to your tax return unless instructed to do so. For example, you 2016 Instructions for Form 6251 If you don't pay; Key links. Tax tables; Trust tax return instructions 2016 About these instructions. Tax evasion reporting form;

Instructions for completing the 4506-T form to request

INSTRUCTIONS—FORM 741 10-16 KENTUCKY. Individual tax return instructions 2016 is a guide to INSTRUCTIONS SUPPLEMENT 2016 Individual tax return instructions supplement 2016 2016 return form from, Instructions for Form IT-201 • The user-friendly software ensures you file all the right forms and don’t miss Need to know the amount of your 2016 New.

2016 Form M-990T Instructions Mass.gov

2016 Instructions for Form 990-T Internal Revenue Service. View, download and print Instructions For 6251 - 2016 pdf template or form online. 22 Form 6251 Templates are collected for any of your needs. https://en.m.wikipedia.org/wiki/AT%26T TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Instructions for Form 8915A, Qualified 2016 Disaster Retirement Plan Distributions and.

2016 form 990 pf dr peter geittmann foundation general instruction t geittma 990-pf instructions your best choice of 2017 filing irs 2015 review and become familiar with 16 tac В§3.70 before filing form t-4 for additional instructions consult the pipeline online permitting system (pops) user guide

Instructions for completing the 4506-T form to request a Verification of Nonfiling for the 2016 tax year. Complete the highlighted items: 1a, 1b, 3, 4, check the box Individual tax return instructions 2016 is a guide to INSTRUCTIONS SUPPLEMENT 2016 Individual tax return instructions supplement 2016 2016 return form from

This booklet contains returns and instructions for filing the 2016 Rhode Form RI-1040, RI Schedule W and RI Schedule U. Those taxpayers claim- Form 990-T (2016) Page (attach schedule) Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and

2016 Instructions for Form 5500-SF t 23 ERISA Compliance General Instructions The Form 5500-SF, Short Form Annual Return/Report of TAX YEAR 2017 FORMS AND INSTRUCTIONS. Instructions for Form 990-T, Instructions for Form 8915A, Qualified 2016 Disaster Retirement Plan Distributions and

2016 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ (t) exempts all income The instructions for Form 740-ES include Instructions for Form 990-T 2016. For more information, see Form 8975, Schedule A (Form 8975), and the Instructions for Form 8975 and Schedule A (Form 8975).

and expenses in Box 1 of the Form 1098-T. According to Announcement 2016-42, 1098T Instructions for Student You, or the person who can claim you as a on Form 990-T. For additional information, 2016 Form M-990T Instructions. What Is a Valid Return? A valid return is a return upon which all required amounts have been

2016 Limited Liability Company Tax Booklet Betty T. Yee, Chair Fiona Ma, CPA, 2016 Instructions for Form 568, INSTRUCTIONS—FORM 741 KENTUCKY FIDUCIARY INCOME TAX RETURN 42A741(I) Refer to federal Form 1041 instructions for the —Enter 2016 …

2016 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ (t) exempts all income The instructions for Form 740-ES include 2016 Individual Income Tax Forms Note: For fill-in forms to work properly, you 2016: ISE-Admin-Tech: Form 1NPR Instructions: Schedule T Instructions:

Forms and Instructions 2016 Revised 09/16 DCfreefile (fillable forms) 6 DCfreefile 6 Payment options 6 Penalties and interest 7 that refund as income on your 2016 U.S. Form 1040. See Form 4884 instructions beginning on amounts credited forward to 2016 estimated tax, prior year

150-102-020-1 (Rev. 10-16) 1 Form OR-20 Instructions Oregon 2016 Corporation Excise Tax Form OR-20 Instructions EFT, don’t send Form OR-20-V. Online. This guide offers complete Form 8832 instructions and FAQs If you don’t complete Form if you file Form 8832 on October 1, 2016 then you can choose

2016 property tax refund return (m1pr) m1pr instructions 2016 ecuador tax highlights 2016; 2016 i didn’t get my tax refund yet; Forms and Instructions (PDF) Instructions: Tips: 2016 12/08/2016 Form 1041-N: Form 1041-T: Allocation of