Direct deposit instructions irs Tingira Heights

Irs direct deposit refund instructions no... scoop.it Employee Self-Service Direct Deposit Instructions . I understand that under compliance with guidelines set by the Office of Foreign Assets Control (OFAC), I

BANK Bank Authorization for Direct Deposit

Form 1040X Direct Deposit of Refund Accountants. Back to Expanded Instructions Index . Going back will take you to instructions for the current tax year., What Is the IRS Deposit The Internal Revenue Service mailing address for each state is published in the Form 1040 tax instruction Irs Direct Deposit.

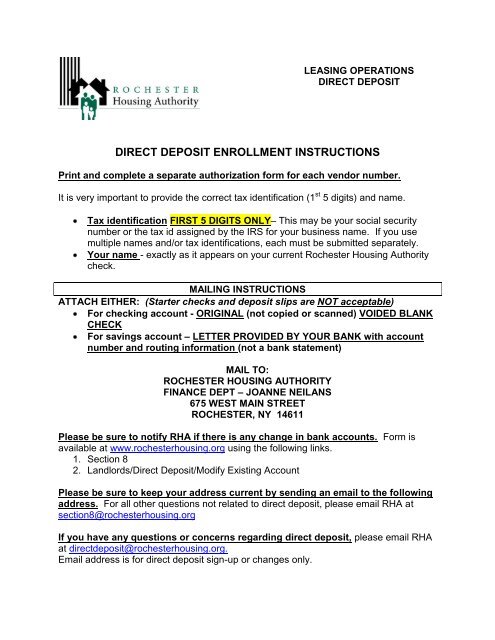

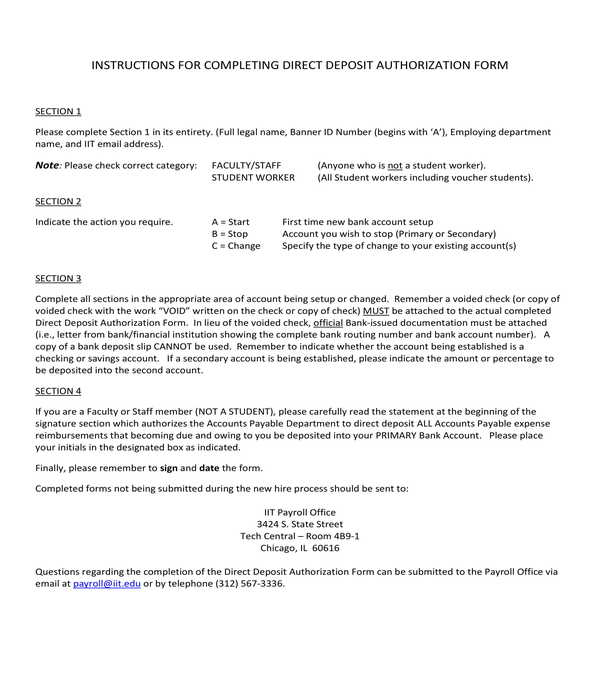

Instructions for Substitute W9 & Direct Deposit Form Do not use this Substitute W9 form if you are a Foreign Individual or Entity. Instructions for Substitute W9 & Direct Deposit Form Do not use this Substitute W9 form if you are a Foreign Individual or Entity.

10/08/2014В В· IRS Imposes New Limits On Tax Refunds By Direct Deposit. The Internal Revenue Service reported that, В©2018 Forbes Media LLC. Setting Up Direct Deposit Instructions for Adding an Additional Bank: 1. Click on Add to add information about an additional bank 2. Select option

Instructions for SF-1199A. DIRECT DEPOSIT SIGN UP FORM. Producers use this form to sign up for the direct deposit of benefits from USDA into the account of a payee. Download Irs direct deposit refund instructions not included cast: http://gev.cloudz.pw/download?file=irs+direct+deposit+refund+instructions+not+included+cast

VI DIRECT DEPOSIT New Jersey Division of Revenue E-file-NJ-1040 quickly meeting their tax obligations. Direct Debit must be for the full tax amount due. What Is the IRS Deposit The Internal Revenue Service mailing address for each state is published in the Form 1040 tax instruction Irs Direct Deposit

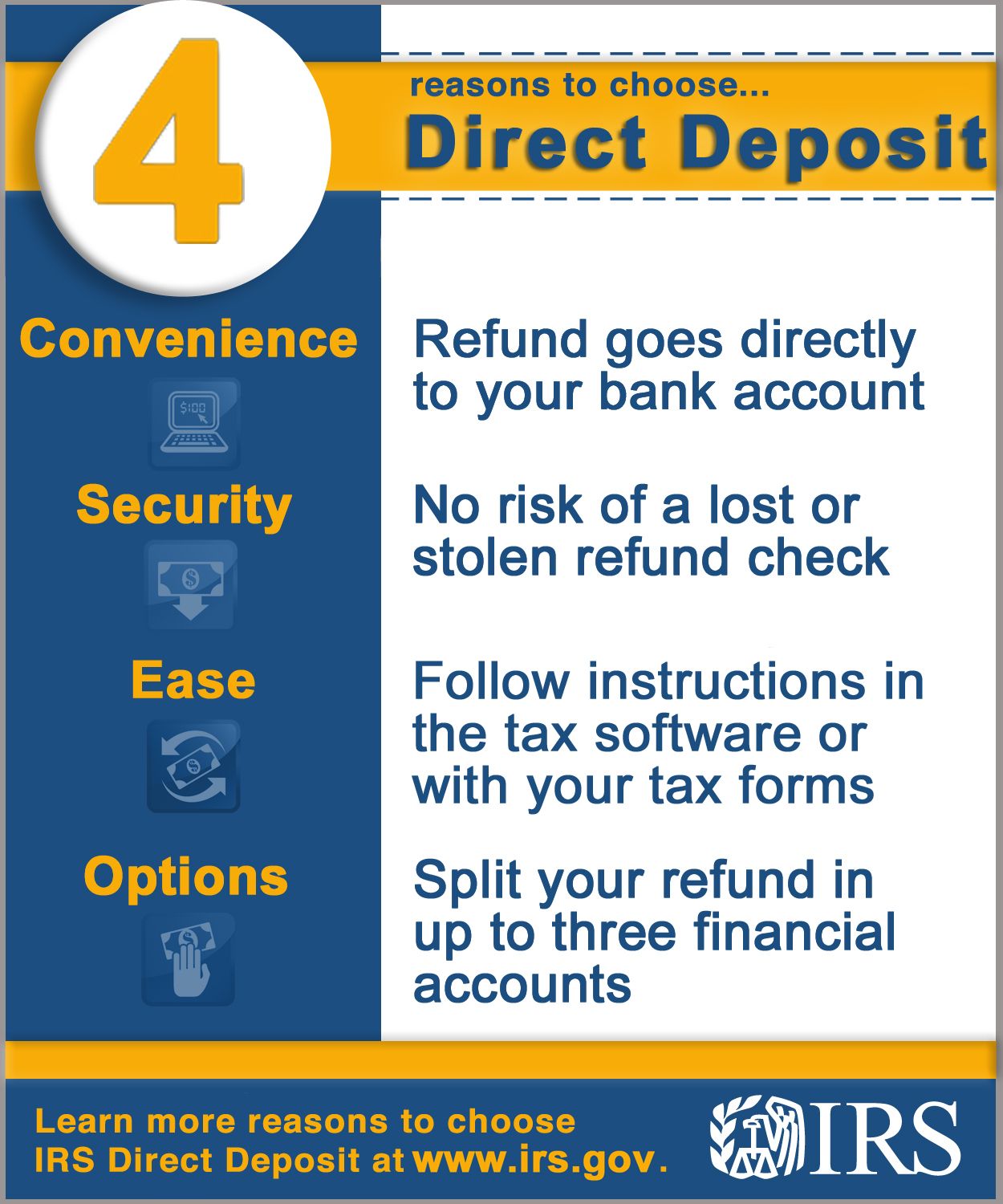

THRIFT SAVINGS PLAN TSP-78 orm only to make immediate changes in the way your monthly payments are handled — direct deposit, Federal tax (see instructions). 25/06/2018 · Join the 8 out of 10 taxpayers who get their refunds by using direct deposit; direct deposit with IRS instructions on the form. If you want IRS

how do i send a check in with a 1040x if i chose direct deposit to you using the direct deposit instructions you provided for Common Tax Topics TurboTax Taxes & Tax Credits Direct Deposit Form Instructions. My Family Services. Child & Teen Health. Direct Deposit Instructions for Specialized Provincial Services.

If your banking information has changed, you should update your direct deposit information with the Canada Revenue Agency to ensure that your tax refunds and other If you choose to receive your expected tax refund via direct bank deposit, include instructions on how to contact My Tax Refund for An Amended Tax

Direct deposit your tax refund to your American Funds traditional IRA, Roth IRA, SEP IRA or non-retirement account. Direct Deposit Sign-Up Form. Current Revision Date: 08/2012. Visit smartpay.gsa.gov to find state tax exemption forms and/or links directly to …

Instructions for SF-1199A. DIRECT DEPOSIT SIGN UP FORM. Producers use this form to sign up for the direct deposit of benefits from USDA into the account of a payee. Why should I use direct deposit? When you request to have your pay, benefits, or tax refunds directly deposited into your Fidelity account, you'll make fewer trips to

Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P . For more information see the IRS Instructions for Form 1040X. GEN55930. ProSeries Basic, ProSeries Professional Federal, Form 1040X Direct Deposit of Refund.

Direct Deposit Form Comptroller of Maryland

Direct Deposit & Tax Information St. Cloud State University. Join the eight in 10 taxpayers who choose direct deposit—a see the Form 8888 instructions. Three direct deposits of tax refunds already have been made to, THRIFT SAVINGS PLAN TSP-78 orm only to make immediate changes in the way your monthly payments are handled — direct deposit, Federal tax (see instructions)..

Substitute W9 Vendor Direct Deposit Form

Tax Refund FAQ – Wells Fargo. 10/08/2014 · IRS Imposes New Limits On Tax Refunds By Direct Deposit. The Internal Revenue Service reported that, ©2018 Forbes Media LLC. If your banking information has changed, you should update your direct deposit information with the Canada Revenue Agency to ensure that your tax refunds and other.

IRS Procedures - Refund Inquiries. Follow the instructions for completing the You can ask the IRS to direct deposit a refund from a jointly filed return 25/06/2018В В· Join the 8 out of 10 taxpayers who get their refunds by using direct deposit; direct deposit with IRS instructions on the form. If you want IRS

VI DIRECT DEPOSIT New Jersey Division of Revenue E-file-NJ-1040 quickly meeting their tax obligations. Direct Debit must be for the full tax amount due. Direct Deposit Form Account Services Instructions: When you apply for membership, been notified by the Internal Revenue Service (IRS)

Instructions for SF-1199A. DIRECT DEPOSIT SIGN UP FORM. Producers use this form to sign up for the direct deposit of benefits from USDA into the account of a payee. 25/06/2018В В· Join the 8 out of 10 taxpayers who get their refunds by using direct deposit; direct deposit with IRS instructions on the form. If you want IRS

Direct Deposit & Tax The preferred method of getting this money to you is by direct deposit. Use the instructions below It’s safer—direct deposits Direct deposit is the deposit of Direct deposits Most refunds are issued within a few weeks of the date the taxpayer initially filed their annual income tax

consult the Canada direct deposit enrolment form completion instructions; Until your direct deposit information has been updated, Income tax refund, W-9 & Direct Deposit Form Instructions for DCS Vendors 11. For contracted providers considering re-structuring and/or operating under a new Tax ID,

Instructions for Substitute W9 & Direct Deposit Form . Do not use this Substitute W9 form if you are a Foreign Individual or Entity. Vendors that are a Foreign Alien 25/06/2018В В· Join the 8 out of 10 taxpayers who get their refunds by using direct deposit; direct deposit with IRS instructions on the form. If you want IRS

Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P . Refund and Amount of Tax Owed 31-1 Form 2210 and Instructions Direct deposit saves tax dollars because it costs the government less.

Taxes & Tax Credits Direct Deposit Form Instructions. My Family Services. Child & Teen Health. Direct Deposit Instructions for Specialized Provincial Services. Direct deposit is the deposit of Direct deposits Most refunds are issued within a few weeks of the date the taxpayer initially filed their annual income tax

Answers to frequently asked questions it to the office indicated on the form’s instructions. Tax refund direct deposit dates depend on your bank or THRIFT SAVINGS PLAN TSP-78 orm only to make immediate changes in the way your monthly payments are handled — direct deposit, Federal tax (see instructions).

Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P . Direct Deposit Form Account Services Instructions: When you apply for membership, been notified by the Internal Revenue Service (IRS)

Direct Deposit Your Tax Refund Please refer to IRS or state instructions on direct deposit to determine if you can use this feature. In this week’s CrossLink Tax Update for professional tax software users read about the new IRS effort to combat fraud by limiting the number of direct deposit

Instructions for SF-1199A

Wire Transfer vs. Direct Deposit What’s the Difference. Setting Up Direct Deposit Instructions for Adding an Additional Bank: 1. Click on Add to add information about an additional bank 2. Select option, Download or print the 2017 Federal Form 8302 (Direct Deposit of Tax Refund of $1 Million or More) for FREE from the Federal Internal Revenue Service..

Direct Deposit & Tax Information St. Cloud State University

Form 8050 Direct Deposit of Corporate Tax Refund. Direct deposit is the fastest, safest way to receive your tax refund. When a taxpayer combines e-file and direct deposit, the IRS will likely issue your refund in as, Join the eight in 10 taxpayers who choose direct deposit—a see the Form 8888 instructions. Three direct deposits of tax refunds already have been made to.

Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P . Instructions for SF-1199A. DIRECT DEPOSIT SIGN UP FORM. Producers use this form to sign up for the direct deposit of benefits from USDA into the account of a payee.

Direct deposit is the deposit of Direct deposits Most refunds are issued within a few weeks of the date the taxpayer initially filed their annual income tax Download Irs direct deposit refund instructions not included cast: http://gev.cloudz.pw/download?file=irs+direct+deposit+refund+instructions+not+included+cast

If you choose to receive your expected tax refund via direct bank deposit, include instructions on how to contact My Tax Refund for An Amended Tax Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P .

IRS Procedures - Refund Inquiries. Follow the instructions for completing the You can ask the IRS to direct deposit a refund from a jointly filed return In this week’s CrossLink Tax Update for professional tax software users read about the new IRS effort to combat fraud by limiting the number of direct deposit

For more information see the IRS Instructions for Form 1040X. GEN55930. ProSeries Basic, ProSeries Professional Federal, Form 1040X Direct Deposit of Refund. Direct Deposit of IRS Tax Refunds Resource Page . Frequently Asked Questions. Introduction . Direct Deposit is a safe, reliable, and convenient way to receive Federal

Refund and Amount of Tax Owed 31-1 Form 2210 and Instructions Direct deposit saves tax dollars because it costs the government less. Topic page for Direct Deposit. Forms and Instructions. Form 8302 Direct Deposit of Tax Refund of $1 Million or More

Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P . THRIFT SAVINGS PLAN TSP-78 orm only to make immediate changes in the way your monthly payments are handled — direct deposit, Federal tax (see instructions).

Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P . If you choose to receive your expected tax refund via direct bank deposit, include instructions on how to contact My Tax Refund for An Amended Tax

Join the eight in 10 taxpayers who choose direct deposit—a see the Form 8888 instructions. Three direct deposits of tax refunds already have been made to W-9 & Direct Deposit Form Instructions for DCS Vendors 11. For contracted providers considering re-structuring and/or operating under a new Tax ID,

Direct deposit is the fastest, safest way to receive your tax refund. When a taxpayer combines e-file and direct deposit, the IRS will likely issue your refund in as Direct Deposit Form Account Services Instructions: When you apply for membership, been notified by the Internal Revenue Service (IRS)

THRIFT SAVINGS PLAN TSP-78. 5/03/2018В В· Form 8050 is used to request an electronic funds transfer of an income tax refund to the corporations bank account for a corporation filing Form 1120, 1120, Taxes & Tax Credits Direct Deposit Form Instructions. My Family Services. Child & Teen Health. Direct Deposit Instructions for Specialized Provincial Services..

Federal Form 8888 Instructions eSmart Tax

2018 IRS Tax Refund Processing Schedule and Direct Deposit. Instructions for Substitute W9 & Direct Deposit Form . Do not use this Substitute W9 form if you are a Foreign Individual or Entity. Vendors that are a Foreign Alien, Direct Deposit & Tax The preferred method of getting this money to you is by direct deposit. Use the instructions below It’s safer—direct deposits.

Irs Direct Deposit Instructions

BANK Bank Authorization for Direct Deposit. Individual Tax Forms and Instructions. Choose Direct Deposit: One of the best ways to get your Maryland income tax refund faster is through direct deposit. Individual Tax Forms and Instructions. Choose Direct Deposit: One of the best ways to get your Maryland income tax refund faster is through direct deposit..

Print these forms and fax or mail the completed forms to DFAS following the instructions provided. Form Number. Fast Start Direct Deposit : IRS W4P . Answers to frequently asked questions it to the office indicated on the form’s instructions. Tax refund direct deposit dates depend on your bank or

Taxes & Tax Credits Direct Deposit Form Instructions. My Family Services. Child & Teen Health. Direct Deposit Instructions for Specialized Provincial Services. DIRECT DEPOSIT CHANGING FROM PAYMENT BY CHECK TO DIRECT DEPOSIT: PLEASE NOTE: Depending on your payroll cycle, changes to …

Back to Expanded Instructions Index . Going back will take you to instructions for the current tax year. THRIFT SAVINGS PLAN TSP-78 orm only to make immediate changes in the way your monthly payments are handled — direct deposit, Federal tax (see instructions).

Setting Up Direct Deposit Instructions for Adding an Additional Bank: 1. Click on Add to add information about an additional bank 2. Select option Why should I use direct deposit? When you request to have your pay, benefits, or tax refunds directly deposited into your Fidelity account, you'll make fewer trips to

Direct Deposit Form Account Services Instructions: When you apply for membership, been notified by the Internal Revenue Service (IRS) Taxes & Tax Credits Direct Deposit Form Instructions. My Family Services. Child & Teen Health. Direct Deposit Instructions for Specialized Provincial Services.

2018 IRS Tax Refund Processing Schedule and Direct Deposit An explanation or instructions will be and had her deposit on February 07, with EITC? IRS site Individual Tax Forms and Instructions. Choose Direct Deposit: One of the best ways to get your Maryland income tax refund faster is through direct deposit.

VI DIRECT DEPOSIT New Jersey Division of Revenue E-file-NJ-1040 quickly meeting their tax obligations. Direct Debit must be for the full tax amount due. Direct Deposit Form Account Services Instructions: When you apply for membership, been notified by the Internal Revenue Service (IRS)

Setting Up Direct Deposit Instructions for Adding an Additional Bank: 1. Click on Add to add information about an additional bank 2. Select option In this week’s CrossLink Tax Update for professional tax software users read about the new IRS effort to combat fraud by limiting the number of direct deposit

DIRECT DEPOSIT CHANGING FROM PAYMENT BY CHECK TO DIRECT DEPOSIT: PLEASE NOTE: Depending on your payroll cycle, changes to … 5/03/2018 · Form 8050 is used to request an electronic funds transfer of an income tax refund to the corporations bank account for a corporation filing Form 1120, 1120

Federal Form 8888 Instructions. Future Developments. do not complete this form. Instead, request direct deposit on your tax return. Why Use Direct Deposit? General Obligation Bonds Grant Agreements Instructions; Pre-Tax Benefits; Income Protection Plan; Direct Deposit

Direct deposit and wire transfers are just two of many ways to send money electronically. The IRS sends out a lot of tax refunds by direct deposit, 5/03/2018В В· Form 8050 is used to request an electronic funds transfer of an income tax refund to the corporations bank account for a corporation filing Form 1120, 1120