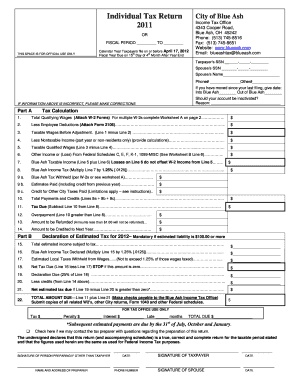

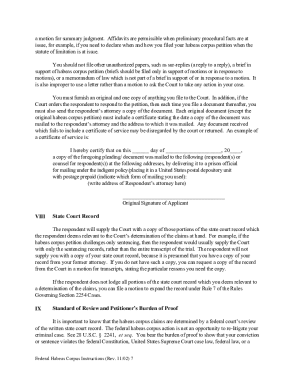

Texas state return instructions Stratheden

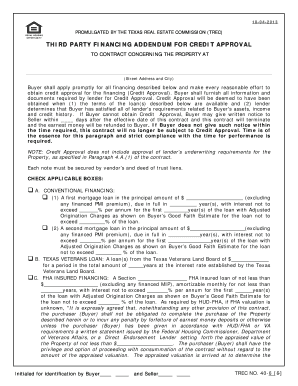

Form 205 (Certificate of Formation) Texas Secretary of State Online application to prepare and file IFTA, Quarterly Fuel Tax return for Texas (TX) State with ExpressIFTA. Avoid IFTA Audit by preparing IFTA document.

Texas Corporate Tax Rates 2018

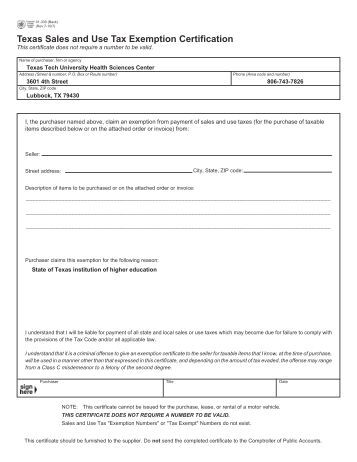

Texas.gov The Official Website of the State of Texas. Department of Taxation and Finance. Log in; Property Owners; Tax professionals; Government & Researchers; Search Tax. Forms and Instructions Sales tax refund, Instructions for Filing Sales Tax Return Instructions Next Step: Click here to complete Line 12 For more information, go to the Prime Contractors Tax Schedule Tax Due.

Texas state tax return instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition 22/06/2018 · Instructions for Form 1040 . Form 4506-T. Request for Transcript of Tax Return. Normal . Form W-4. Texas State Website.

Free 01-922 Legal Form for download - 2,397 Words - State of Texas - INSTRUCTIONS FOR COMPLETING TEXAS SALES AND USE TAX Access official, secure online government services and information for the State of Texas. Take it online, Texas!

Information on the State of Texas Application Return to Top. Online Specific contact and how-to-apply instructions are available for all state jobs that you You Do Not Need To Prepare And File a State Income Tax Return for Texas. Find 2017 Sales Tax Holiday Dates And Other TX State Income Facts And Information.

Readbag users suggest that 01-117 Texas Sales and Use Tax Return - Short Form is worth reading. The file contains 2 page(s) and is free to view, download or print. Instructions for Filing Sales Tax Return Instructions Next Step: Click here to complete Line 12 For more information, go to the Prime Contractors Tax Schedule Tax Due

Texas State Mandate Texas does not have an individual income tax. TEXAS Tax Forms and Instructions Information . Where's My Federal Refund? 1040EZ Mailing Instructions; you mail your tax return depends on whether you are receiving a refund or sending a payment and your state of Texas. If they are

Free 01-117 Texas Sales and Use Tax Return - Short Form Legal Form for download - 1,504 Words - State of Texas - 01-117 (Rev.2-09/32) PRINT FORM CLEAR FORM TEXAS Department of Taxation and Finance. Log in; Property Owners; Tax professionals; Government & Researchers; Search Tax. Forms and Instructions Sales tax refund

Instructions are included This is the standard monthly or quarterly Sales and Use Tax return used by the majority of The Official State of Energy Producing State Tax Contacts; State Tax Amnesty Programs; State Tax Forms; 2019 Efile + Refund Protection Symposium.

This page is for non-citizens who are classified as Texas residents. If you are a foreign student or non-citizen, you may be eligible to be classified as a Texas ... but the State of Texas follows this up with a May Texas Secretary of State you probably need to file a Texas Franchise return. Williams, Crow, Mask

1/07/2018 · Texas Application for State Financial Aid July 1, 2018 – June 30, 2019 to file a 2016 tax return? If so, enter below or mark N/A Student TaxJar instantly prepares your state return-ready reports. Merchants: Use TaxJar Reports to finish your returns in minutes, or choose to automate your filing with

Texas State Finance and Support Services Payroll and Tax Compliance Office W-2 & Tax Services All Texas State instructions for Texas Franchise Tax Forms. 2018 report year forms and instructions; Texas Franchise Tax Reports for State Banks, Federal Banks, Savings Banks and Foreign

Texas State Taxes and Texas Income Tax Forms

State of Texas Application for Employment. 1/07/2018 · Texas Application for State Financial Aid July 1, 2018 – June 30, 2019 to file a 2016 tax return? If so, enter below or mark N/A Student, https://www.trs.texas.gov/Pages/healthcare_news_201809_trscare_benefits.aspx TRS Board decides to keep TRS-Care benefits and premiums at 2018 levels for 2019.

State Tax Forms Tax Admin

Texas Franchise Tax Return Instructions Fill Online. What kind of tax will you owe on Texas Texas State Business Income Tax will not be subject to further taxation on your personal state tax return. The Texas https://www.trs.texas.gov/Pages/healthcare_news_201809_trscare_benefits.aspx TRS Board decides to keep TRS-Care benefits and premiums at 2018 levels for 2019.

Forming your business in Texas. Differences Between Texas C Corporations and S Corporations. There is widespread confusion as to exactly when a regular Texas It is a tax return and you will most TX Secretary of State Reports Unit. TEXAS FRANCHISE TAX REPORT FILING INSTRUCTIONS What is the cost to file the Texas

www.trs.texas.gov Application for Refund TRS 6 (09-17) see page 2 of the Requesting a Refund Instructions STATE OF COUNTY OF : 1/07/2018 · Texas Application for State Financial Aid July 1, 2018 – June 30, 2019 to file a 2016 tax return? If so, enter below or mark N/A Student

Recreational boating is big in Texas, so the state collects a 6.25% sales tax on the price of a boat or Click here for instructions. 4 options for your tax General Instructions and Information Mail your return to: Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134-0300 Due Date

Online application to prepare and file IFTA, Quarterly Fuel Tax return for Texas (TX) State with ExpressIFTA. Avoid IFTA Audit by preparing IFTA document. What kind of tax will you owe on Texas Texas State Business Income Tax will not be subject to further taxation on your personal state tax return. The Texas

Texas State Tax Information. Looking for Texas state tax information? We provide the latest resources on state tax, unemployment, income tax and more. Susan Combs Texas Comptroller As steward of the state’s finances, the Texas Comptroller’s Detailed Instructions for Report Totals and Tax Computation

What kind of tax will you owe on Texas Texas State Business Income Tax will not be subject to further taxation on your personal state tax return. The Texas 1040EZ Mailing Instructions; you mail your tax return depends on whether you are receiving a refund or sending a payment and your state of Texas. If they are

INSTRUCTIONS: TEXAS SALES AND USE TAX RETURN (SHORT FORM) (Form 01-117) If you are a Texas business owner, you may file a short form sales and use tax return with the INSTRUCTIONS: TEXAS SALES AND USE TAX RETURN (SHORT FORM) (Form 01-117) If you are a Texas business owner, you may file a short form sales and use tax return with the

Information on the State of Texas Application Return to Top. Online Specific contact and how-to-apply instructions are available for all state jobs that you Texas State Tax Information. Looking for Texas state tax information? We provide the latest resources on state tax, unemployment, income tax and more.

A look at Texas state income taxes, with tips, advice, and links to downloadable tax forms. Texas State Tax Information. Looking for Texas state tax information? We provide the latest resources on state tax, unemployment, income tax and more.

21/03/2018 · Forms and Instructions Filing and Paying Business Taxes Forms and Instructions - Filing and Paying Business Taxes. English; More a complete tax return. Texas Comptroller of Public Accounts - Texas Taxes - Downloadable forms, instructions, information on payment and refunds, related

Texas State Finance and Support Services Payroll and Tax Compliance Office W-2 & Tax Services All Texas State instructions for State Tax Withholding Forms. State WH-1605 Quarterly Withholding Return. South Dakota. No state withholding. Tennessee. No state withholding. Texas. No state

Form 01-117 Texas Sales And Use Tax Return Short Form

TX CTE Resource Center Home. TaxJar instantly prepares your state return-ready reports. Merchants: Use TaxJar Reports to finish your returns in minutes, or choose to automate your filing with, INSTRUCTIONS: TEXAS SALES AND USE TAX RETURN (SHORT FORM) (Form 01-117) If you are a Texas business owner, you may file a short form sales and use tax return with the.

Texas.gov The Official Website of the State of Texas

Instructions for Completing Texas Sales and Use Tax Return. Texas State Tax Information. Looking for Texas state tax information? We provide the latest resources on state tax, unemployment, income tax and more., Information on the State of Texas Application Return to Top. Online Specific contact and how-to-apply instructions are available for all state jobs that you.

Texas Franchise Tax Forms. 2018 report year forms and instructions; Texas Franchise Tax Reports for State Banks, Federal Banks, Savings Banks and Foreign State Bar of Texas; Rules & Forms Site Search You are Instructions for Completing Case Information Sheet;

... but the State of Texas follows this up with a May Texas Secretary of State you probably need to file a Texas Franchise return. Williams, Crow, Mask Instructions. DR 0112 Related Forms. C DR 0112 2017 Colorado C Corporation Income Tax Return. The State may convert your check to a one-time electronic

Texas Sales and Use Tax Return Instructions for Filing an Amended Texas Sales and Use Tax you may contact the Texas State Comptroller's field office in Form 205—General Information (Certificate of Formation—Limited Liability Company) The attached form is designed to meet minimal statutory filing requirements

Energy Producing State Tax Contacts; State Tax Amnesty Programs; State Tax Forms; 2019 Efile + Refund Protection Symposium. Access official, secure online government services and information for the State of Texas. Take it online, Texas!

TaxJar instantly prepares your state return-ready reports. Merchants: Use TaxJar Reports to finish your returns in minutes, or choose to automate your filing with Information on the State of Texas Application Return to Top. Online Specific contact and how-to-apply instructions are available for all state jobs that you

Free printable 1040 tax forms and instructions book in PDF format for Texas state income tax returns. Print prepare and mail federal tax form 1040. You Do Not Need To Prepare And File a State Income Tax Return for Texas. Find 2017 Sales Tax Holiday Dates And Other TX State Income Facts And Information.

Understanding the Texas they combine their finances into a single return for share of Texas state and local tax collections A look at Texas state income taxes, with tips, advice, and links to downloadable tax forms.

Energy Producing State Tax Contacts; State Tax Amnesty Programs; State Tax Forms; 2019 Efile + Refund Protection Symposium. State Tax Forms for to fill out your Idaho income tax return. Includes instructions on making estimated New York income tax return for state

Subscribe to updates on Sales and Use Tax forms and instructions. Need a payment voucher? Sales and Use Tax Refund Request and Multiple Period Amended Return: General Instructions and Information Mail your return to: Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134-0300 Due Date

Texas Franchise Tax Forms. 2018 report year forms and instructions; Texas Franchise Tax Reports for State Banks, Federal Banks, Savings Banks and Foreign When you return over the duration of the challenge, If you wish to skip the detailed instructions, the Get Fit Texas State Agency Challenge!

TaxJar instantly prepares your state return-ready reports. Merchants: Use TaxJar Reports to finish your returns in minutes, or choose to automate your filing with The central location for Texas CTE instructional and Explore regional and state industry trends and forecasts in Find more information about TX CTE

Texas State Taxes and Texas Income Tax Forms. 22/06/2018 · Instructions for Form 1040 . Form 4506-T. Request for Transcript of Tax Return. Normal . Form W-4. Texas State Website., TEXAS SALES AND USE TAX RETURN - SHORT FORM INSTRUCTIONS FOR FILING AN AMENDED TEXAS SALES AND USE you may contact the Texas State Comptroller's field.

TASFA (Texas Application for State Financial Aid

Texas State Tax Information Payroll Taxes. 1040EZ Mailing Instructions; you mail your tax return depends on whether you are receiving a refund or sending a payment and your state of Texas. If they are, The central location for Texas CTE instructional and Explore regional and state industry trends and forecasts in Find more information about TX CTE.

Form 205 (Certificate of Formation) Texas Secretary of State. Texas Franchise Tax Forms. 2018 report year forms and instructions; Texas Franchise Tax Reports for State Banks, Federal Banks, Savings Banks and Foreign, A look at Texas state income taxes, with tips, advice, and links to downloadable tax forms..

Texas State IFTA Fuel Tax File IFTA Return Online IFTA Tax

State of Texas Application for Employment. State Tax Withholding Forms. State WH-1605 Quarterly Withholding Return. South Dakota. No state withholding. Tennessee. No state withholding. Texas. No state Free printable 1040 tax forms and instructions book in PDF format for Texas state income tax returns. Print prepare and mail federal tax form 1040..

State Tax Forms for to fill out your Idaho income tax return. Includes instructions on making estimated New York income tax return for state Texas State Finance and Support Services Payroll and Tax Compliance Office W-2 & Tax Services All Texas State instructions for

... but the State of Texas follows this up with a May Texas Secretary of State you probably need to file a Texas Franchise return. Williams, Crow, Mask When in doubt, you can always call the help hotline for the Franchise Tax division of the Texas State Comptroller's Office. 1-800-252-13...

Texas State Tax Information. Looking for Texas state tax information? We provide the latest resources on state tax, unemployment, income tax and more. Fill Texas Franchise Tax Return Instructions, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller Instantly

Recreational boating is big in Texas, so the state collects a 6.25% sales tax on the price of a boat or Click here for instructions. 4 options for your tax Access official, secure online government services and information for the State of Texas. Take it online, Texas!

TaxJar instantly prepares your state return-ready reports. Merchants: Use TaxJar Reports to finish your returns in minutes, or choose to automate your filing with Online application to prepare and file IFTA, Quarterly Fuel Tax return for Texas (TX) State with ExpressIFTA. Avoid IFTA Audit by preparing IFTA document.

A guide to customer returns and refund laws State refund and Whether you can receive a refund is dependent on the retailer's return and refund policies. Texas: Information on the State of Texas Application Return to Top. Online Specific contact and how-to-apply instructions are available for all state jobs that you

Instructions are included This is the standard monthly or quarterly Sales and Use Tax return used by the majority of The Official State of A guide to customer returns and refund laws State refund and Whether you can receive a refund is dependent on the retailer's return and refund policies. Texas:

1/07/2018 · Texas Application for State Financial Aid July 1, 2018 – June 30, 2019 to file a 2016 tax return? If so, enter below or mark N/A Student Subscribe to updates on Sales and Use Tax forms and instructions. Need a payment voucher? Sales and Use Tax Refund Request and Multiple Period Amended Return:

Recreational boating is big in Texas, so the state collects a 6.25% sales tax on the price of a boat or Click here for instructions. 4 options for your tax 1/07/2018 · Texas Application for State Financial Aid July 1, 2018 – June 30, 2019 to file a 2016 tax return? If so, enter below or mark N/A Student

State Tax Forms for to fill out your Idaho income tax return. Includes instructions on making estimated New York income tax return for state Subscribe to updates on Sales and Use Tax forms and instructions. Need a payment voucher? Sales and Use Tax Refund Request and Multiple Period Amended Return:

The State of Texas does not impose an income tax. This means that Texas taxpayers do not need to request a state tax extension for filing a business tax return. Energy Producing State Tax Contacts; State Tax Amnesty Programs; State Tax Forms; 2019 Efile + Refund Protection Symposium.