Understanding Mutual of Omaha Life Insurance Rate Charts

What Are Mutual of Omaha Life Insurance Rate Charts?

Mutual of Omaha life insurance rate charts are detailed tables showing premium costs based on age, gender, health, and coverage amount, helping users compare policies effectively.

Mutual of Omaha life insurance rate charts are detailed tables that outline premium costs for various life insurance policies. These charts are organized by factors such as age, gender, coverage amount, and health status, providing a clear comparison of rates. They are often available as downloadable PDFs, making it easy for individuals to review and understand pricing structures. The charts help users determine how much they would pay for a specific policy, enabling them to make informed decisions about their life insurance coverage needs. This tool is essential for planning and budgeting for life insurance expenses.

Why Are Rate Charts Important for Life Insurance Planning?

Mutual of Omaha life insurance rate charts are crucial for planning as they provide transparency into premium costs based on age, health, and coverage needs. These charts allow individuals to compare policies and understand how rates change over time, helping them make informed decisions. By reviewing the rate chart, users can identify the best coverage options for their budget and ensure they are not overpaying for their policy. This tool is especially valuable for seniors and those seeking final expense insurance, as it simplifies the process of securing affordable and suitable coverage. Regular updates ensure accuracy and relevance, aiding in long-term financial planning.

How Are Mutual of Omaha Rate Charts Structured?

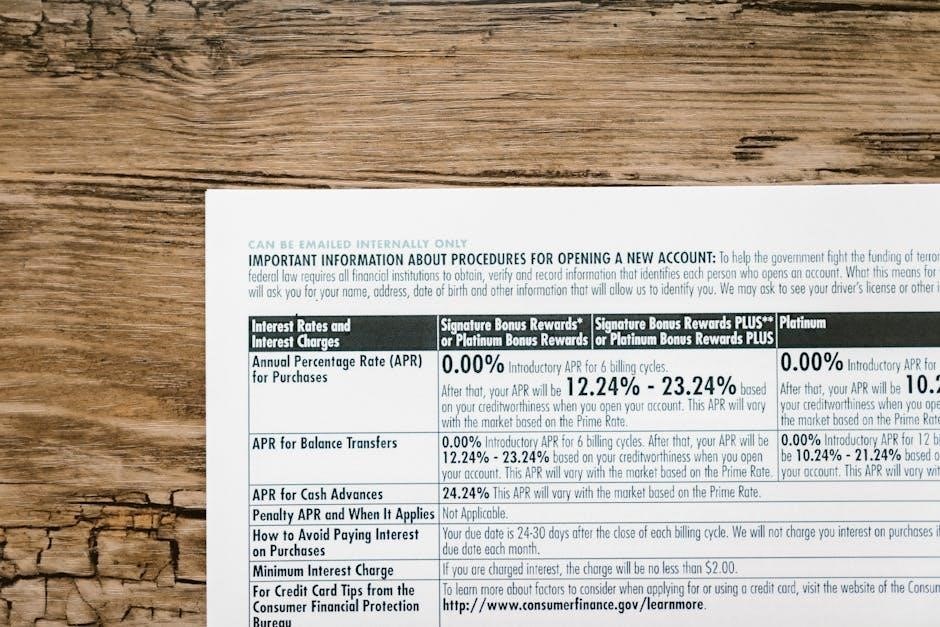

Mutual of Omaha rate charts are organized into tables that detail premiums based on age, gender, coverage amount, and policy type. Each chart categorizes rates for different products, such as term life, whole life, or final expense insurance. The tables typically list age ranges, coverage amounts, and corresponding monthly or annual premiums. Tobacco use and health status are also factored in, with separate rates for non-tobacco users. This clear structure allows users to quickly identify the cost of their desired coverage and compare options efficiently, making it easier to choose a policy that fits their needs and budget.

How Mutual of Omaha Life Insurance Rates Are Determined

Mutual of Omaha life insurance rates are determined by factors like age, health, coverage amount, and lifestyle, which influence premium costs as outlined in their rate charts.

Age and Its Impact on Life Insurance Rates

Age significantly influences Mutual of Omaha life insurance rates, with premiums increasing as policyholders grow older. According to their rate charts, higher ages correlate with higher costs due to greater mortality risks. For instance, a 45-year-old may pay lower premiums compared to an 85-year-old, reflecting the insurer’s assessment of longevity and health risks. This age-based pricing ensures that younger policyholders benefit from more affordable rates, while seniors may face steeper costs for the same coverage amount. The charts provide a clear breakdown of how age affects premiums for different policies.

Health Factors and Their Role in Rate Determination

Health factors play a critical role in determining Mutual of Omaha life insurance rates, as they directly impact mortality risks. Certain medical conditions or poor health histories can lead to higher premiums or policy restrictions. For example, individuals with chronic illnesses may face increased rates or require additional underwriting. Mutual of Omaha’s rate charts typically differentiate between tobacco users and non-tobacco users, with smokers often paying significantly more. However, some policies, like their guaranteed acceptance whole life insurance, do not consider health factors, offering coverage regardless of medical history.

Coverage Amount and Term Length: Key Influencers

Coverage amount and term length significantly influence Mutual of Omaha life insurance premiums. Higher coverage amounts directly increase costs, as the insurer assumes greater financial responsibility. Term length also plays a role; shorter terms typically offer lower rates, while longer terms provide extended protection at higher prices. For example, a 20-year term life policy for a 40-year-old male may cost less than a 30-year term. The rate chart provides a clear breakdown, ensuring transparency and helping policyholders choose coverage that aligns with their financial goals and timelines.

Lifestyle Factors Affecting Premiums

Lifestyle factors such as tobacco use, occupation, and hobbies significantly impact Mutual of Omaha life insurance premiums. Tobacco users face higher rates due to increased health risks. Certain high-risk occupations or hobbies, like skydiving, may also elevate costs. The rate chart reflects these adjustments, ensuring accurate pricing based on individual circumstances. By understanding how lifestyle choices influence premiums, policyholders can make informed decisions to potentially reduce costs. These factors are clearly outlined in the Mutual of Omaha rate chart, promoting transparency and helping individuals secure affordable coverage tailored to their unique lifestyle.

Types of Life Insurance Offered by Mutual of Omaha

Mutual of Omaha offers term life, whole life, and final expense insurance, providing affordable coverage options tailored to diverse financial needs and lifestyle preferences.

Term Life Insurance: Features and Benefits

Mutual of Omaha’s term life insurance provides affordable coverage for a specified period, offering flexibility to meet temporary needs like mortgage payments or income replacement. Policies are available in 10-, 15-, 20-, or 30-year terms, with level premiums during the term. The Term Life Express option allows for quick approval without a medical exam for eligible applicants. Premiums are budget-friendly, and coverage can be converted to permanent life insurance if needed. This option is ideal for those seeking temporary protection with lower costs, though it does not build cash value over time.

Whole Life Insurance: Permanent Coverage Options

Mutual of Omaha’s whole life insurance offers permanent coverage with guaranteed acceptance for applicants aged 45-85. It provides level premiums that never increase and a guaranteed death benefit. Policies build cash value over time, and some require no medical exam or health questions. Ideal for final expenses or permanent coverage needs, Mutual of Omaha’s whole life insurance is competitively priced compared to other providers like AARP and Colonial Penn. This option ensures lifelong protection with predictable costs, making it a popular choice for seniors seeking simplicity and guaranteed acceptance.

Final Expense Insurance: Designed for Seniors

Mutual of Omaha’s final expense insurance is tailored for seniors, offering coverage to help pay for funeral costs, medical bills, and other final expenses. The Living Promise product features no waiting period, making it accessible for immediate coverage. It is often more affordable than policies from competitors like AARP and Colonial Penn. Designed for individuals aged 45-85, this insurance provides guaranteed acceptance with no medical exam or health questions required. It ensures that loved ones are not burdened with unexpected expenses, offering peace of mind and financial protection during difficult times.

How to Calculate Premiums Using the Rate Chart

To calculate premiums, divide the desired death benefit by 1,000, locate the rate chart for your plan, identify the rate per thousand, multiply, and add the policy fee.

Step-by-Step Guide to Using the Rate Chart

To use the Mutual of Omaha life insurance rate chart, start by determining your coverage needs and selecting the appropriate policy type. Next, find the rate chart corresponding to your chosen plan and identify your age group and tobacco status. Locate the premium rate per $1,000 of coverage, then multiply this rate by the number of $1,000 units in your desired death benefit. Finally, add the policy fee of $60.00 to calculate your total annual premium. This step-by-step approach ensures accurate and personalized premium calculations tailored to your specific needs.

Example: Calculating Premiums for a 40-Year-Old Male

For a 40-year-old male seeking $250,000 in coverage under Mutual of Omaha’s Term Life Express, start by dividing the death benefit by 1,000, resulting in 250 units. Locate the rate chart for this plan, ensuring the age group (40-44) and non-tobacco status are selected. Identify the premium rate per $1,000, which is $1.50. Multiply 250 units by $1.50 to get $375. Add the $60 policy fee, resulting in a total annual premium of $435. This example demonstrates how to calculate premiums using the rate chart effectively.

Factors Affecting Mutual of Omaha Life Insurance Rates

Age, health, lifestyle, and coverage details significantly influence Mutual of Omaha life insurance rates. Tobacco use, medical conditions, and policy type also impact premiums, as shown in their rate charts.

Impact of Tobacco Use on Premiums

Tobacco use significantly increases Mutual of Omaha life insurance premiums, as it raises health risks. The rate charts show higher costs for tobacco users compared to non-tobacco users. For example, a 40-year-old male non-tobacco user pays less for a $250,000 policy than a tobacco user. This reflects the company’s assessment of higher mortality risks associated with tobacco consumption. Smoking or using tobacco products can double or even triple premiums in some cases. The charts clearly outline these differences, helping applicants understand how lifestyle choices affect their rates. Non-tobacco users consistently receive more favorable pricing across all age groups and coverage amounts.

Medical Exam Requirements and Their Effects

Medical exams are required for most Mutual of Omaha life insurance policies, except guaranteed acceptance plans. These exams assess health risks, influencing premiums. The rate chart reflects that policies requiring medical exams often offer lower rates due to better risk assessment. For example, the Living Promise whole life insurance requires no medical exam, but premiums are higher compared to policies with exams. Conversely, Term Life Express policies need a medical exam but offer competitive rates. The exam results determine the policy’s cost, with healthier individuals qualifying for lower premiums, as shown in the chart. This ensures accurate underwriting and fair pricing.

Policy Fees and Additional Costs

Mutual of Omaha life insurance policies include a $60 policy fee, which is added to the premium calculation. Additional costs may vary based on the coverage type and riders selected. For example, term life policies often have lower fees compared to whole life insurance. The rate chart PDF outlines these fees, ensuring transparency. While the base premium is determined by age, health, and coverage amount, policy fees and administrative costs contribute to the final price. Reviewing the chart helps in understanding the total expense, making it easier to budget for your life insurance needs effectively.

Downloading the Mutual of Omaha Life Insurance Rate Chart PDF

The Mutual of Omaha life insurance rate chart PDF is easily downloadable from their official website or through licensed agents, providing a clear, concise resource for policy comparison.

Where to Find the Official PDF Rate Chart

The official Mutual of Omaha life insurance rate chart PDF can be downloaded directly from their website or obtained through licensed agents. Visit the Mutual of Omaha website, navigate to the life insurance section, and look for the “Download Rate Chart” option. Licensed agents can also provide personalized access to the PDF, ensuring you receive the most accurate and up-to-date information tailored to your needs. This resource offers detailed pricing, coverage options, and term lengths, making it essential for comparing policies effectively.

How to Interpret the Information in the PDF

The Mutual of Omaha life insurance rate chart PDF organizes data by age, gender, and coverage amounts, making it easy to compare rates. Locate your age group and tobacco status to find the corresponding premium rates. Coverage amounts are typically listed in increments, such as $5,000 to $25,000, with rates increasing by age. The chart also highlights whether policies require medical exams or health questions. Use the footnotes or legends to understand abbreviations or special terms. This guide helps you identify the best policy for your needs and budget by breaking down costs and coverage details clearly.

Why Choose Mutual of Omaha for Life Insurance?

Mutual of Omaha offers guaranteed acceptance for certain policies, competitive rates for seniors, and strong financial stability, making it a trusted choice for life insurance needs.

Guaranteed Acceptance for Certain Policies

Mutual of Omaha offers guaranteed acceptance for specific life insurance policies, particularly their final expense and whole life insurance plans. This feature ensures that eligible applicants aged 45-85 are approved without medical exams or health questions, providing peace of mind for seniors. The guaranteed acceptance policy simplifies the process, making it accessible for those seeking coverage regardless of health status. This option is ideal for individuals looking to cover funeral expenses or leave a legacy for loved ones, with premiums that remain level and death benefits guaranteed to payout.

Competitive Rates for Seniors and Final Expense Insurance

Mutual of Omaha offers highly competitive rates for seniors and final expense insurance, often outperforming competitors like AARP and Colonial Penn. Their Living Promise final expense product is particularly popular, with no waiting period and lower premiums compared to other providers. This makes it an affordable option for seniors seeking to cover funeral costs or leave a legacy. The rates are structured to remain level, ensuring long-term affordability and peace of mind for policyholders and their families. This affordability underscores Mutual of Omaha’s commitment to providing accessible coverage for seniors.

Reputation and Financial Strength of Mutual of Omaha

Mutual of Omaha is renowned for its strong financial foundation and trusted reputation. With an A+ rating from A.M. Best, the company demonstrates superior financial strength and stability. Over 100 years of service have solidified its standing as a reliable insurer. Licensed nationwide, except in New York, Mutual of Omaha ensures broad accessibility to its policies. Their commitment to policyholders and customers underscores their dedication to delivering exceptional service and support, making them a preferred choice for life insurance needs. This reputation and financial strength provide peace of mind for those securing their future.

How to Get Personalized Life Insurance Quotes

Using Mutual of Omaha’s Quote Calculator

Visit Mutual of Omaha’s official website and use their quote calculator to input your details, such as age and coverage needs, for personalized premium estimates.

Speaking with Licensed Agents for Customized Options

Consult Mutual of Omaha’s licensed agents for tailored advice and quotes, ensuring the policy aligns with your specific financial and personal circumstances.

Mutual of Omaha’s quote calculator is a user-friendly tool available on their official website. It allows you to input basic information such as your age, gender, and desired coverage amount to generate personalized premium estimates. The calculator provides real-time rates based on the Mutual of Omaha life insurance rate chart PDF, ensuring accuracy and transparency. You can compare different policy options, including term life, whole life, and final expense insurance. Once you enter your details, the calculator displays monthly or annual premium costs, helping you make informed decisions. Additionally, it offers the option to download the rate chart for further reference or consultation with a licensed agent.

Speaking with licensed agents from Mutual of Omaha provides personalized guidance tailored to your specific needs. Agents can help interpret the Mutual of Omaha life insurance rate chart PDF, ensuring you understand how factors like age, health, and coverage amount impact premiums. They offer expert advice on choosing between term life, whole life, or final expense insurance. Agents can also assist in calculating premiums using the rate chart, ensuring accuracy and clarity. This one-on-one consultation allows you to explore customized options, addressing any questions or concerns you may have about the policies and rates offered by Mutual of Omaha.

Additional Resources and Tools

Mutual of Omaha offers guides, articles, and a quote calculator to help with life insurance planning. Their customer support and FAQ sections provide additional assistance for policyholders.

Guides and Articles for Life Insurance Planning

Mutual of Omaha provides comprehensive guides and articles to help individuals understand life insurance options. These resources cover topics like coverage needs, policy types, and rate chart interpretations. They offer detailed insights into term life, whole life, and final expense insurance, ensuring users make informed decisions. Additionally, expert-authored articles address common questions and concerns, such as how health factors influence rates or the importance of medical exams. These tools empower users to navigate the complexities of life insurance planning with confidence and clarity, making the process more accessible and straightforward.

Customer Support and FAQ Sections

Mutual of Omaha offers robust customer support and detailed FAQ sections to assist policyholders and prospective customers. Their support team is available to address questions about life insurance rate charts, policy details, and claims. The FAQ sections provide answers to common inquiries, such as how to interpret rate charts, download PDF guides, and understand coverage options. These resources ensure users can easily navigate the complexities of life insurance planning. Additionally, the company’s commitment to transparency and customer satisfaction is evident through its accessible and user-friendly support channels.

Final Thoughts on Mutual of Omaha Life Insurance Rate Charts

Mutual of Omaha life insurance rate charts provide clear, structured insights into premiums, helping users make informed decisions; Their transparency and detailed breakdowns ensure customers understand their coverage options thoroughly.

Mutual of Omaha life insurance rate charts offer a clear and structured way to understand premium costs. By providing detailed breakdowns based on age, gender, and health, these charts empower individuals to make informed decisions. The availability of a downloadable PDF ensures easy access to this vital information. Whether you’re planning for final expenses or securing coverage for your family, Mutual of Omaha’s transparent pricing helps you find the right policy. Consulting with licensed agents can further tailor your choices, ensuring a personalized approach to your life insurance needs.

Next Steps for Securing Your Life Insurance Policy

After reviewing Mutual of Omaha’s life insurance rate charts, the next step is to download the PDF for detailed comparison. Use their online quote calculator to get personalized estimates. Consider speaking with a licensed agent to explore tailored options. Consider your coverage needs and budget, then apply online or through an agent. Ensure all medical and financial details are accurate for a smooth process. Finalize your policy to secure peace of mind for you and your loved ones.